User Story

- Current architecture of Tax Category and Tax Template with Tax Rules is complex and need too many configurations.

- Also, its difficult to make customers understand them and its need.

- At times it leads to duplication of data, where validations may miss out and could lead to errors. Eg: When customer is from different state, there should not be a need to again specify tax category for that customer. Also, there is still no accurate validation between these two, and could lead to errors.

- Going ahead if users use the system to file the returns, proper validations need to be in place, to ensure errors at the time of transaction.

Current Tax Laws

How do we determine if its Inter State Transaction or Intra State Transaction?

It depends on Place of Supply and state where the company is located. If these two are different, then its considered as Inter State Transaction else its Intra State Transaction

How can the place of supply be determined?

References

In most cases its the state of billing address of customer. However in exceptional cases it can be different. For Eg:

- For stay at hotel/food at restaurant or place where construction/installation on site happens, state where it is supplied will be place of supply.

- Where a professional is delivering a service (say giving a lecture), and that service is only given from this particular place and delivered there itself, the place of supply will be state where the service is given.

Exceptions to above scenarios:

- For Export or Import (Overseas or SEZ but not Deemed Export), Its always IGST that is applicable in these cases even if say SEZ is in same State (As it is considered as a different state i.e. other territory).

When is reverse charge applicable?

Reference

- Purchases made from unregistered persons (with some threshold of Rs 5000)

- Purchases made from specified persons (like transporter)

Proposed Solution

We propose that rows in tax table can populate automatically with just some basic configuration in GST Settings.

- In GST Settings, user can give default place of supply is based on Billing Address or Company Address.

- User will still have an option to change the place of supply, for some exceptional cases for any transaction.

- Based on the place of supply vs state of company, we can populate tax accounts in tax table.

How can we determine tax rates?

As a part of Item Tax Template, we only need the tax rates applicable to that item or if not applicable if that item is nil rated, exempted or zero rated and we can then apply them accordingly.

How can we deal with concessional tax rates or cases were we would like to exclude a transaction from GST returns?

We plan to have a field where if user chooses Out of Scope, the transaction will be not included in GST returns and no taxes will come up.

Also, if user uses Concessional Tax Rates, he will have option to override item tax rates (Say, 0.1% for goods meant for exports).

eg: Supply to Merchant Exporter

How do we ensure branch transfer in GST?

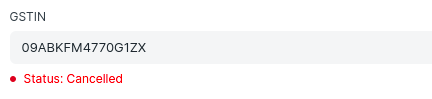

As a part of GST Settings, where user currently specifies the GST Accounts, we can ask for GST Accounts for each GSTIN. Rest within a transaction, we are already considering Company Address/ Company GSTIN to check which tax accounts are applicable.

How can we handle reverse charge?

- Again in GST Settings user can enable reverse charge transactions. They can set a custom threshold for purchases from unregistered persons.

- We already are differentiating transporters in supplier through a checkbox. So we can make it configurable to ensure reverse charge for all transporter.

- For other suppliers also we can enable this through a checkbox.

- For each purchase transaction, there will be a checkbox to check if this transaction comes under reverse charge.

eg scenarios:

Unregistered Supplier --> Purchase Less than Threshold --> No Tax Accounts.

Unregistered Supplier --> Purchase More than Threshold --> Reverse Charge Accounts.

Registered Supplier --> RCM Applicable --> Reverse Charge Accounts

How do we handle complex transactions like exports or deemed exports or SEZ?

Exports/SEZ shall be with or without payment of tax, as per default GST Settings if LUT is available. Deemed Exports shall we with payment of tax. More on this in a separate topic.

How this method will ensure complete validations?

In case user has defined something incorrectly at an earlier stage, incorrect taxes comes up, and will not match with the invoice provided by the Supplier. Also, where a sales invoice is made, incorrect taxes in sales invoice will mean masters are not correct. This will also ensure that all masters are updated and correct.

Debateable Issues

How do we migrate existing users?

We suggest not to migrate, as its a part of configuration which users may have been used to until now. Also, errors here can cause issues. So, tax category and template stays for those who want to use it. However user can make few settings and opt-into this method / trigger manual patch to clear existing settings.

What if tax accounts that come up are not acceptable to user? If there is some other account he wants to use in exceptional scenario?

This is completely unlikely considering we also cover exports and imports.

What if user wants to maintain separate tax accounts for each tax rate?

Separate tax accounts for tax rates:

- Does not solve any problem (alternatives are already available, or a separate report can be easily available for same),

- Is difficult to maintain, and complicates existing process, (difficult to reconcile with GST ledgers)

- Not required by law

Small standardizations like this will simplify managing/maintaining this.