Privacy-focused, free, powerful crypto tax calculator

- Introduction

- License

- Download

- Installation

- Running

- Input and Output Files

- Supported Countries and Accounting Methods

- RP2 Ecosystem

- Reporting Bugs

- Contributing

- Developer Documentation

- Frequently Asked Questions

- Change Log

RP2 is a privacy-focused, free, non-commercial, open-source, community-driven cryptocurrency tax calculator for multiple countries. Preparing crypto taxes can be a daunting and error-prone task, especially if multiple transactions, coins, exchanges and wallets are involved. This task could be delegated to a crypto tax preparation service, but many crypto users value their privacy and prefer not to send their transaction information to third parties unnecessarily. Additionally, many of these services cost money. RP2 solves all of these problems:

- it manages the complexity related to coin flows and tax calculation and it generates reports that accountants can understand (in the format of form 8949, for the US case), even if they are not cryptocurrency experts;

- it prioritizes user privacy by storing crypto transactions and tax results on the user's computer and not sending them anywhere else;

- it's 100% free, open-source and non-commercial.

This means that with RP2 there are no transaction limits, no premium versions, no payment requests, no personal data sent to a server (at risk of being hacked), no account creation, no unauditable source code.

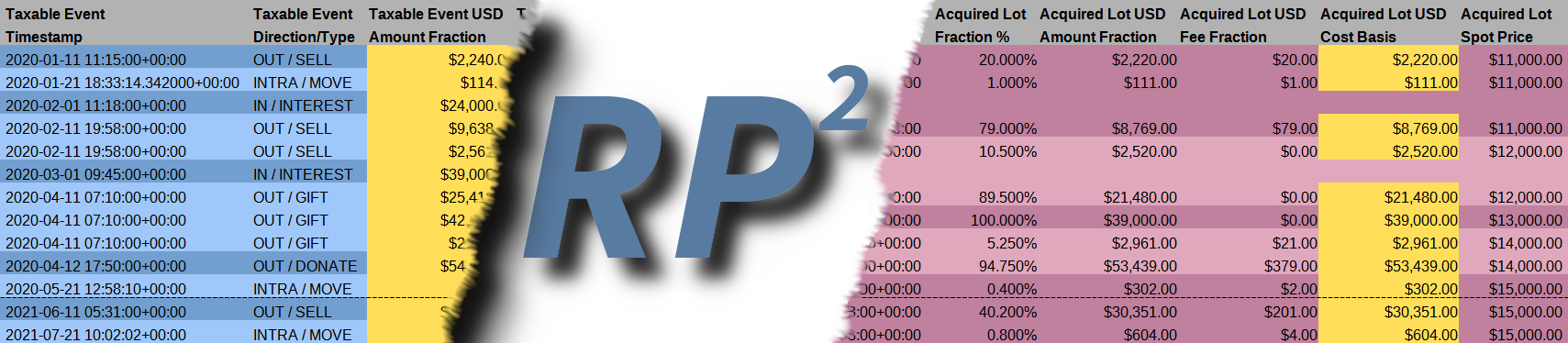

Another unique advantage of RP2 is transparent computation: RP2 generates full computation details for every lot fraction, so that it's possible to:

- verify step-by-step how RP2 reaches the final result;

- track down every lot fraction and its accounting details, in case of an audit.

RP2 supports most countries and various accounting methods, which vary country by country.

RP2 reads a configuration file and an input spreadsheet containing crypto transactions. These input files can be generated either manually or automatically using DaLI, a RP2 data loader and input generator (which is also privacy-focused, free, non-commercial, open-source and community-driven). After parsing the input, RP2 uses high-precision math to calculate long/short term capital gains, cost bases, balances, average price, in/out lot relationships/fractions, and finally it generates output files.

RP2 has a programmable plugin architecture for output generators, accounting methods and countries. Built-in output generator plugins vary country by country, but RP2's architecture makes it possible to contribute additional generators for different countries or for different country-based cases.

RP2 has extensive unit test coverage to reduce the risk of regression.

IMPORTANT DISCLAIMERS:

- RP2 offers no guarantee of correctness (read the license): always verify results with the help of a tax professional.

- The author of RP2 is not a tax professional, but has used RP2 personally for a few years.

RP2 has been designed to have expressive primitives that can be used as building blocks for most tax scenarios: complex tax events can be described with patterns, built on top of these primitives (see the FAQ list for examples).

For the US case, RP2 treats virtual currency as property for tax purposes, as per IRS Virtual Currency Guidance.

RP2 supports various accounting methods (e.g. FIFO, LIFO, HIFO): however, in and out lots typically don't have matching amounts, so RP2 fractions them, maps in/out lot fractions and computes the resulting cost basis and capital gains for each lot fraction.

RP2 groups lot fractions into the following taxable event categories, each of which has a specific tax treatment:

- AIRDROP: gains from airdrops;

- DONATE: donations to charitable organizations;

- FEE: fee-only transaction, used in some DeFi scenarios (e.g. gas fee for running certain smart contracts);

- GIFT: gifts to parties who are not charitable organizations (not tax-deductible).

- HARDFORK: gains from hard forks;

- INCOME: gains from miscellaneous income (e.g. Coinbase Earn);

- INTEREST: gains from interest;

- MINING: gains from mining;

- MOVE: the fee for moving currency between two accounts controlled by the same owner;

- SELL: specifically, sale and conversion of a cryptocurrency to another. RP2 splits them in two subcategories:

- long-term capital gains (if supported by the country plugin: e.g. in the US it's 1 year or more), or

- short-term capital gains otherwise;

- STAKING: gains from staking;

- WAGES: income from crypto wages.

For each of these categories RP2 generates an output spreadsheet with transaction details and computed gains/losses (see Input and Output Files for more details). Users can give this output to their tax preparer with the rest of their tax documentation (see also FAQ on which tax forms to file). Note that buying cryptocurrency using fiat currency is not a taxable event.

NOTE ON NFTs: Read the FAQ on NFTs to learn about how RP2 treats NFTs.

RP2 is released under the terms of Apache License Version 2.0. For more information see LICENSE or http://www.apache.org/licenses/LICENSE-2.0.

The latest version of RP2 can be downloaded at: https://pypi.org/project/rp2/

RP2 has been tested on Ubuntu Linux, macOS and Windows 10 but it should work on all systems that have Python version 3.8.0 or greater.

Open a terminal window and enter the following commands:

sudo apt-get update

sudo apt-get install python3 python3-pip

Then install RP2:

pip install rp2

First make sure Homebrew is installed, then open a terminal window and enter the following commands:

brew update

brew install python3

Then install RP2:

pip install rp2

First make sure Python 3.8 or greater is installed (in the Python installer window be sure to click on "Add Python to PATH"), then open a PowerShell window and enter the following:

pip install rp2

- install python 3.8 or greater

- install pip3

Then install RP2:

pip install rp2

RP2 requires two files as input:

- an ODS-format spreadsheet, containing crypto transactions (ODS-format files can be opened and edited with LibreOffice and many other spreadsheet applications);

- a config file, describing the format of the spreadsheet file: what value each column corresponds to (e.g. timestamp, amount, exchange, fee, etc.) and which cryptocurrencies and exchanges to expect.

The two input files can either:

- be generated automatically using DaLI, the data loader and input generator for RP2, or

- be prepared manually by the user.

The formats of these files are described in detail in the Input Files section of the documentation.

Examples of an input spreadsheet and its respective config file:

After reading the input files, RP2 computes taxes and generates output files, which contain information on long/short capital gains, cost bases, balances, average price, in/out lot relationships and fractions, etc. They are described in detail in the Output Files section of the documentation.

To try RP2 with example files, download crypto_example.ods and crypto_example.ini. Let's call <download_directory> the location of the downloaded files.

The RP2 executable is country-dependent: rp2_<country_code>, where country code is a ISO 3166-1 alpha-2, 2-letter identifier (e.g. rp2_us, rp2_jp, etc).

To generate US tax output for the example files open a terminal window (or PowerShell if on Windows) and enter the following commands:

cd <download_directory>

rp2_us -n -m fifo -o output -p crypto_example_ crypto_example.ini crypto_example.ods

Results are generated in the output directory and logs are stored in the log directory.

The -m option is particularly important, because is selects the accounting method: rp2_us supports FIFO, LIFO and HIFO (if -m is not specified it defaults to FIFO).

To print full command usage information for the rp2_us command:

rp2_us --help

Read the input files and output files documentation.

Read the supported countries and accounting methods documentation.

This is a call for coders: come and help us expand RP2's functionality!

RP2 is the first component of what could be a powerful, community-driven suite of open-source, crypto tax software. It is intended as the core of a larger project ecosystem, maintained by the community. These projects can extend RP2's capability, usefulness and ease of use in new ways. For example:

- DaLI data loader plugins: add support for more exchanges and wallets (via REST API and/or CSV files). Dali, the RP2 data loader, uses them to generate an input ODS file and a config file that can be fed directly to RP2;

- RP2 plugins: RP2 can be expanded via its programmable plugin architecture, which enables support for new output generators, countries and accounting methods;

- RP2 GUI: make RP2 more user-friendly and accessible to people who are not familiar with the CLI;

- RP2 high-level interface: RP2 captures complex tax events using a few powerful, low-level primitives, aggregated in patterns. A higher level tool, might abstract out these patterns and present them to the user in a friendlier way (for example it may capture a complex concept like DeFi bridging as a primitive, rather than a pattern);

- more...

Important note: any RP2 ecosystem project must make user privacy its first priority.

If you'd like to start an ecosystem project, please open an issue to let the RP2 community know.

Here's the current list of projects in the RP2 ecosystem:

- DaLI: data loader and input generator for RP2 (https://github.com/eprbell/rp2).

Read the Contributing document.

Read the Contributing document.

Read the developer documentation.

Read the user FAQ list and the developer FAQ list.

Read the Change Log document.